All Categories

Featured

Table of Contents

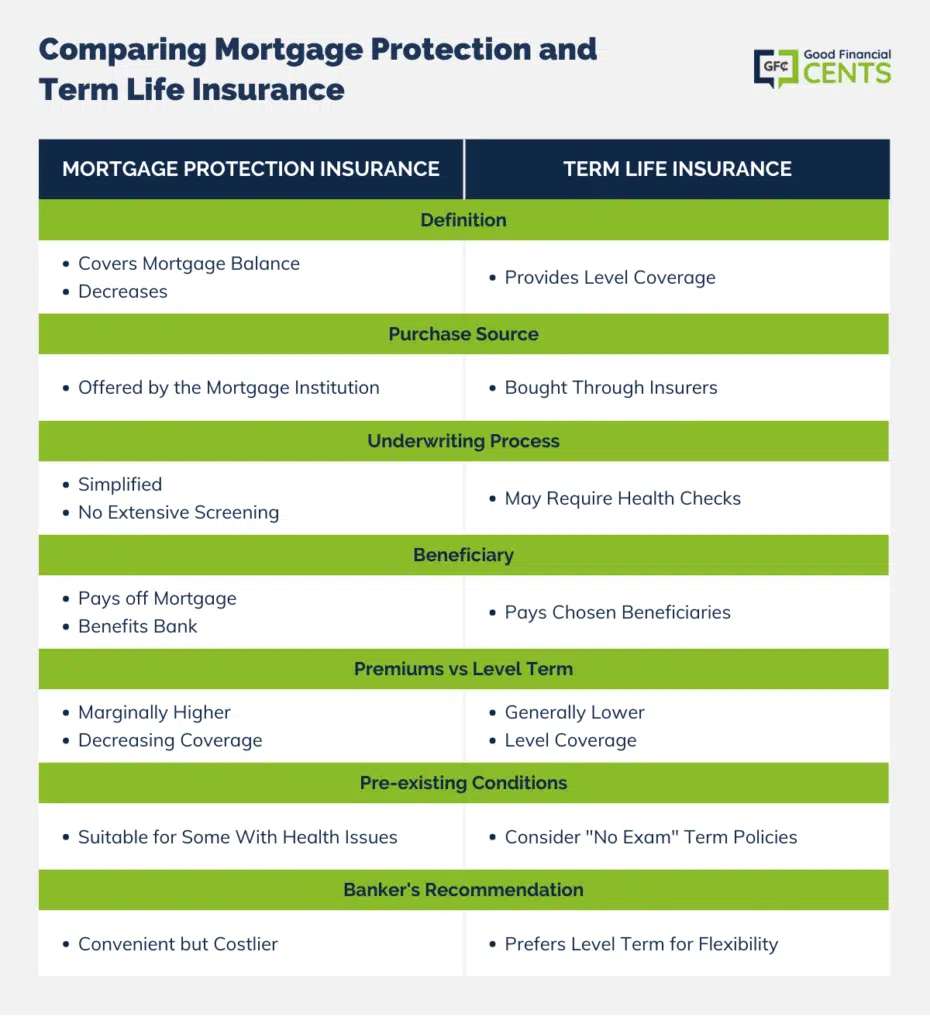

Nonetheless, keeping every one of these acronyms and insurance types straight can be a migraine - what insurance do you need for a mortgage. The adhering to table places them side-by-side so you can promptly separate amongst them if you obtain confused. One more insurance policy coverage type that can repay your home loan if you die is a conventional life insurance coverage plan

A is in area for an established number of years, such as 10, 20 or 30 years, and pays your beneficiaries if you were to pass away throughout that term. A provides protection for your entire life period and pays out when you pass away.

One usual general rule is to intend for a life insurance policy plan that will pay as much as 10 times the policyholder's wage amount. Conversely, you may pick to use something like the penny method, which adds a household's financial debt, earnings, home mortgage and education and learning expenditures to determine just how much life insurance policy is needed (mortgage insurance sales).

It's likewise worth keeping in mind that there are age-related limitations and thresholds enforced by virtually all insurance companies, that commonly will not provide older purchasers as numerous choices, will charge them extra or might deny them outright.

Right here's just how home mortgage defense insurance policy determines up against basic life insurance. If you're able to certify for term life insurance, you must prevent home loan security insurance (MPI).

In those scenarios, MPI can give excellent peace of mind. Every home mortgage security option will certainly have numerous policies, policies, benefit options and disadvantages that need to be evaluated very carefully against your specific situation.

Who Offers Mortgage Insurance

A life insurance coverage policy can assist settle your home's home mortgage if you were to pass away. It's one of numerous manner ins which life insurance policy may aid secure your enjoyed ones and their financial future. Among the most effective means to factor your mortgage right into your life insurance policy demand is to chat with your insurance coverage representative.

As opposed to a one-size-fits-all life insurance policy plan, American Family members Life Insurance coverage Company offers policies that can be developed specifically to meet your household's needs. Here are a few of your choices: A term life insurance policy policy. mortgage loan insurance policy is active for a details amount of time and normally uses a larger amount of protection at a lower price than an irreversible plan

A whole life insurance policy policy is just what it sounds like. Instead of just covering an established variety of years, it can cover you for your whole life. It also has living benefits, such as money worth accumulation. * American Domesticity Insurance coverage Company uses various life insurance policy policies. Talk with your representative regarding customizing a plan or a combination of plans today and obtaining the comfort you deserve.

Your representative is a wonderful resource to answer your concerns. They may also be able to help you discover spaces in your life insurance policy protection or new ways to save on your various other insurance coverage. ***Yes. A life insurance policy recipient can choose to use the survivor benefit for anything - us mortgage protection. It's a wonderful method to help guard the financial future of your family members if you were to die.

Life insurance policy is one way of assisting your family in settling a mortgage if you were to pass away before the home mortgage is completely settled. No. Life insurance policy is not obligatory, yet it can be an important part of assisting make certain your liked ones are monetarily safeguarded. Life insurance policy earnings may be used to aid settle a home mortgage, yet it is not the like home mortgage insurance policy that you might be called for to have as a problem of a car loan.

American Family Mortgage Insurance

Life insurance policy might help ensure your home stays in your family by offering a survivor benefit that might help pay down a home loan or make essential acquisitions if you were to pass away. Contact your American Family members Insurance coverage agent to talk about which life insurance policy plan best fits your needs. This is a short description of protection and undergoes policy and/or cyclist terms, which might differ by state.

Words life time, long-lasting and long-term undergo plan terms and conditions. * Any type of finances drawn from your life insurance coverage plan will build up passion. what is a mortgage insurance. Any type of exceptional financing balance (car loan plus interest) will certainly be deducted from the survivor benefit at the time of claim or from the cash worth at the time of surrender

Discounts do not apply to the life plan. Plan Types: ICC18-33 (10 ), ICC18-33 (15 ), ICC18-34 (20 ), ICC18-35 (30 ), L-33 (10 )(ND), L-33 (15 )(ND), L-34 (20 )(ND), L-35 (30 )(ND), L-33 (10 )(SD), L-33 (15 )(SD), L-34 (20 )(SD), L-35 (30 )(SD), ICC18-36 (10 ), ICC18-36 (15 ), ICC18-36 (20 ), ICC18-36 (30 ), L-36 (10 )(ND), L-36 (15 )(ND), L-36 (20 )(ND), L-36 (30 )(ND), L-36 (10 )(SD), L-36 (15 )(SD), L-36 (20 )(SD), L-36 (30 )(SD), ICC17-225 WL, L-225 (ND) WL, L-225 WL, ICC17-227 WL, L-227 (ND) WL, L-227 WL, ICC17-223 WL, L-223 (ND) WL, L-223 WL, ICC17-224 WL, L-224 (ND) WL, L-224 WL, ICC17-228 WL, L-228 (ND) WL, L-228 WL, ICC21, L141, MS 01 22, L141, ND 02 22, L141, SD 02 22.

Mortgage security insurance policy (MPI) is a different kind of secure that can be handy if you're not able to settle your home mortgage. Home mortgage security insurance policy is an insurance coverage policy that pays off the rest of your home loan if you pass away or if you become handicapped and can not function.

Like PMI, MIP protects the lending institution, not you. Unlike PMI, you'll pay MIP for the duration of the car loan term. Both PMI and MIP are called for insurance coverages. An MPI policy is entirely optional. The amount you'll spend for home loan protection insurance policy depends on a selection of elements, consisting of the insurer and the existing equilibrium of your home loan.

Still, there are pros and disadvantages: A lot of MPI policies are released on a "assured acceptance" basis. That can be helpful if you have a health condition and pay high rates for life insurance or battle to obtain insurance coverage. house loan protection insurance. An MPI policy can offer you and your family with a feeling of security

Mortgage Insurance Prices

It can additionally be useful for people who do not receive or can't pay for a standard life insurance policy plan. You can choose whether you need home loan protection insurance and for the length of time you require it. The terms usually range from 10 to three decades. You might desire your home mortgage protection insurance coverage term to be enclose size to how much time you have actually entrusted to repay your mortgage You can terminate a mortgage security insurance coverage.

Latest Posts

Instant Life Insurance No Exam

Universal Life Insurance Instant Quote

Funeral Insurance Brokers