All Categories

Featured

Table of Contents

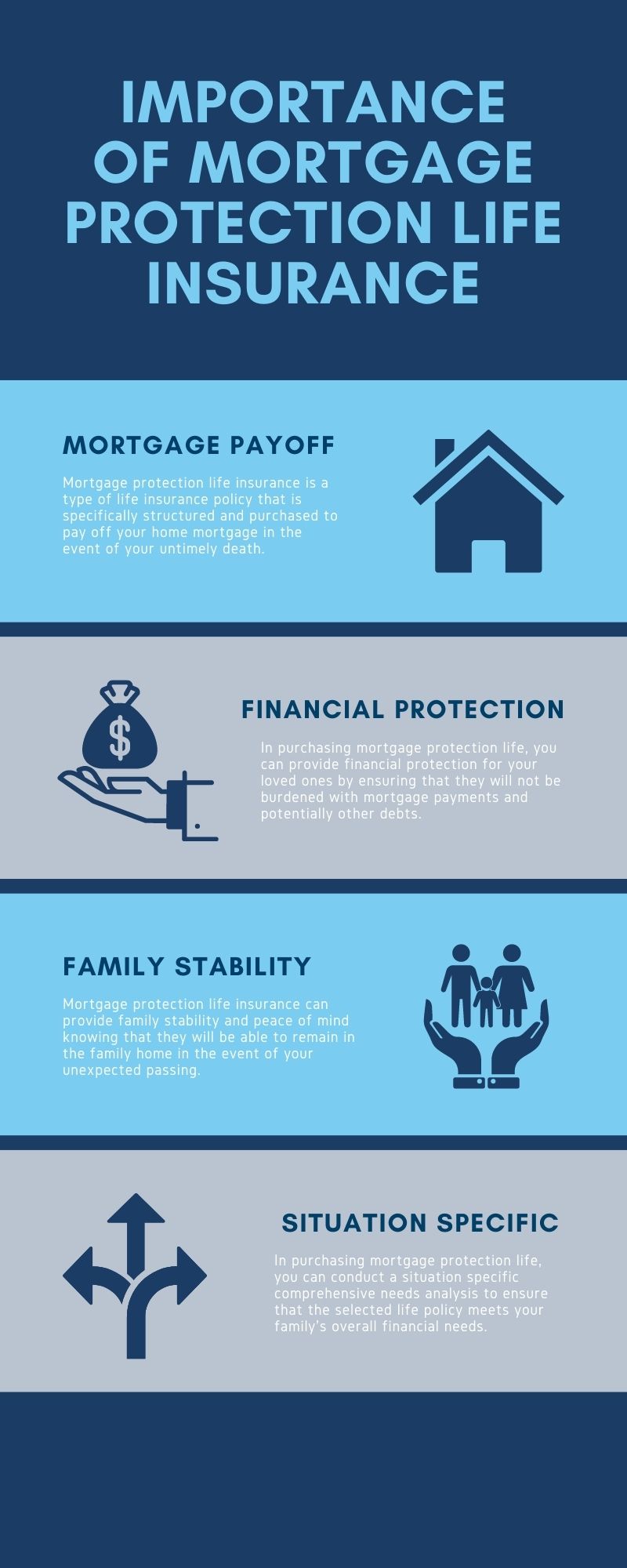

Keeping all of these phrases and insurance kinds right can be a migraine. The complying with table positions them side-by-side so you can promptly set apart among them if you obtain confused. An additional insurance policy coverage kind that can pay off your home mortgage if you pass away is a common life insurance policy

A is in area for a set number of years, such as 10, 20 or 30 years, and pays your beneficiaries if you were to pass away throughout that term. A supplies protection for your whole life period and pays out when you pass away.

One typical guideline is to aim for a life insurance coverage plan that will certainly pay out as much as ten times the policyholder's income quantity. Alternatively, you may pick to use something like the cent approach, which adds a family members's financial obligation, earnings, home loan and education expenditures to determine just how much life insurance policy is required (mppi insurance quote).

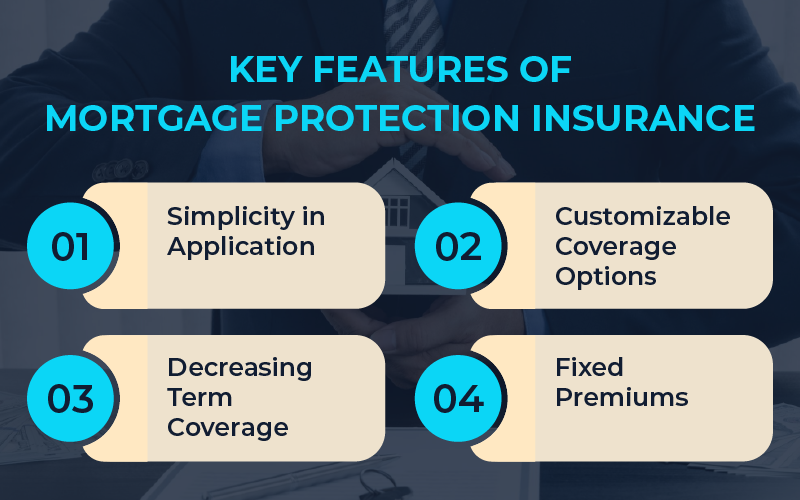

There's a reason brand-new home owners' mailboxes are usually bombarded with "Last Opportunity!" and "Urgent! Action Needed!" letters from home mortgage defense insurance firms: Several only allow you to buy MPI within 24 months of closing on your home loan. It's likewise worth keeping in mind that there are age-related limitations and limits enforced by almost all insurers, who frequently won't offer older purchasers as lots of options, will charge them much more or might refute them outright.

Here's how mortgage security insurance policy determines up against typical life insurance policy. If you're able to receive term life insurance policy, you should stay clear of home mortgage security insurance (MPI). Contrasted to MPI, life insurance policy provides your family a more affordable and much more flexible benefit that you can trust. It'll pay the very same amount no issue when in the term a fatality takes place, and the cash can be made use of to cover any expenditures your family considers required during that time.

In those scenarios, MPI can supply terrific tranquility of mind. Just be sure to comparison-shop and check out every one of the small print before enrolling in any type of policy. Every mortgage security option will have various rules, laws, benefit choices and downsides that require to be weighed meticulously versus your accurate scenario (insurance to protect mortgage payments).

Homebuyer Protection Insurance

A life insurance policy policy can help pay off your home's home mortgage if you were to die. It is among lots of manner ins which life insurance may help safeguard your enjoyed ones and their economic future. One of the very best ways to factor your home loan into your life insurance policy demand is to speak with your insurance representative.

As opposed to a one-size-fits-all life insurance coverage policy, American Domesticity Insurance provider supplies plans that can be made especially to satisfy your family's demands. Right here are several of your choices: A term life insurance policy. mortgage insurance mortgage protect is active for a certain amount of time and usually uses a larger amount of insurance coverage at a reduced cost than an irreversible policy

A entire life insurance coverage plan is just what it sounds like. Instead of only covering an established variety of years, it can cover you for your whole life. It likewise has living advantages, such as money worth accumulation. * American Family Members Life Insurance Firm supplies various life insurance policy plans. Talk with your agent concerning customizing a plan or a mix of policies today and getting the satisfaction you should have.

They may also be able to aid you find gaps in your life insurance coverage or new methods to save on your various other insurance coverage plans. A life insurance policy recipient can select to make use of the death benefit for anything.

Life insurance policy is one means of aiding your household in paying off a home mortgage if you were to pass away before the home mortgage is totally paid back. No. Life insurance policy is not obligatory, however it can be a crucial part of assisting make sure your loved ones are monetarily shielded. Life insurance policy proceeds may be utilized to help repay a home loan, but it is not the like home loan insurance that you may be required to have as a condition of a lending.

Mortgage Redundancy Cover

Life insurance policy may assist guarantee your residence stays in your family by supplying a fatality benefit that may help pay down a home mortgage or make vital acquisitions if you were to pass away. This is a short summary of insurance coverage and is subject to plan and/or motorcyclist terms and conditions, which might vary by state.

Words lifetime, long-lasting and permanent are subject to plan terms. * Any finances extracted from your life insurance policy plan will certainly accumulate rate of interest. how much does mortgage protection insurance cost. Any type of impressive funding balance (loan plus interest) will be deducted from the death benefit at the time of insurance claim or from the cash worth at the time of abandonment

Discounts do not apply to the life plan. Plan Forms: ICC18-33 (10 ), ICC18-33 (15 ), ICC18-34 (20 ), ICC18-35 (30 ), L-33 (10 )(ND), L-33 (15 )(ND), L-34 (20 )(ND), L-35 (30 )(ND), L-33 (10 )(SD), L-33 (15 )(SD), L-34 (20 )(SD), L-35 (30 )(SD), ICC18-36 (10 ), ICC18-36 (15 ), ICC18-36 (20 ), ICC18-36 (30 ), L-36 (10 )(ND), L-36 (15 )(ND), L-36 (20 )(ND), L-36 (30 )(ND), L-36 (10 )(SD), L-36 (15 )(SD), L-36 (20 )(SD), L-36 (30 )(SD), ICC17-225 WL, L-225 (ND) WL, L-225 WL, ICC17-227 WL, L-227 (ND) WL, L-227 WL, ICC17-223 WL, L-223 (ND) WL, L-223 WL, ICC17-224 WL, L-224 (ND) WL, L-224 WL, ICC17-228 WL, L-228 (ND) WL, L-228 WL, ICC21, L141, MS 01 22, L141, ND 02 22, L141, SD 02 22.

Mortgage protection insurance coverage (MPI) is a different type of secure that could be valuable if you're not able to repay your mortgage. Home mortgage protection insurance is an insurance policy that pays off the rest of your home mortgage if you pass away or if you come to be handicapped and can't work.

Both PMI and MIP are called for insurance coverage protections. The amount you'll pay for mortgage defense insurance depends on a variety of variables, including the insurance firm and the existing balance of your mortgage.

Still, there are benefits and drawbacks: Most MPI policies are issued on a "ensured acceptance" basis. That can be helpful if you have a health problem and pay high prices for life insurance coverage or struggle to get coverage. payment protection on loans. An MPI policy can give you and your family with a sense of safety and security

Mortgage Life Insurance Loan

It can likewise be useful for people that do not get approved for or can not manage a traditional life insurance policy. You can select whether you need mortgage protection insurance coverage and for how much time you need it. The terms normally vary from 10 to 30 years. You could desire your mortgage protection insurance policy term to be close in length to how much time you have entrusted to pay off your mortgage You can cancel a home mortgage protection insurance coverage plan.

Latest Posts

Instant Life Insurance No Exam

Universal Life Insurance Instant Quote

Funeral Insurance Brokers